idaho sales tax rate by county

Some Idaho resort cities have a local sales tax in addition to the state sales tax. While many other states allow counties and other localities to collect a local option sales tax Idaho does not.

Idaho has reduced its income tax rates.

. What is the sales tax rate in Elmore County. What is the sales tax rate in Latah County. Local level non-property taxes are allowed within resort cities if.

Has impacted many state nexus laws and sales tax collection. The minimum combined 2022 sales tax rate for Latah County Idaho is. Municipal governments in Idaho are also allowed to collect a local-option sales tax that ranges from 0 to 3 across the state with an average local tax of 0074 for a total of 6074 when.

Some cities and local governments in Idaho County collect additional local sales taxes which can be as high as 1. Look up 2021 Idaho sales tax rates in an easy to navigate table listed by county and city. Lower tax rates tax rebate.

With local taxes the total sales tax rate is between 6000 and 8500. Find your Idaho combined state and local tax rate. The minimum combined 2022 sales tax rate for Elmore County Idaho is.

The corporate tax rate is now 6. County and state tax. The 2018 United States Supreme Court decision in South Dakota v.

The current state sales tax rate in Idaho ID is 6. These local sales taxes are sometimes also referred to as local option taxes because the. Sales Tax Rates in Idaho by County.

Prescription Drugs are exempt from the Idaho sales tax. The minimum combined 2022 sales tax rate for Idaho Falls Idaho is. The Idaho ID state sales tax rate is currently 6.

This is the total of state county and city sales tax rates. Average Sales Tax Including Local Taxes. Local tax rates in Idaho range from 0 to 3 making the sales tax range in Idaho 6 to 9.

This is the total of state and county sales tax rates. What is the sales tax rate in Idaho Falls Idaho. Lowest sales tax 6 Highest sales tax 9 This interactive sales tax map map of.

The Idaho state sales tax. Idaho Sales Tax Map Legend. The base state sales tax rate in Idaho is 6.

For individual income tax the rates range from 1 to 6 and the number of. The Idaho sales tax of 6 applies countywide. Counties and cities can charge an.

This is the total of state and county sales tax rates. Free sales tax calculator tool to estimate total amounts. Idaho has recent rate changes.

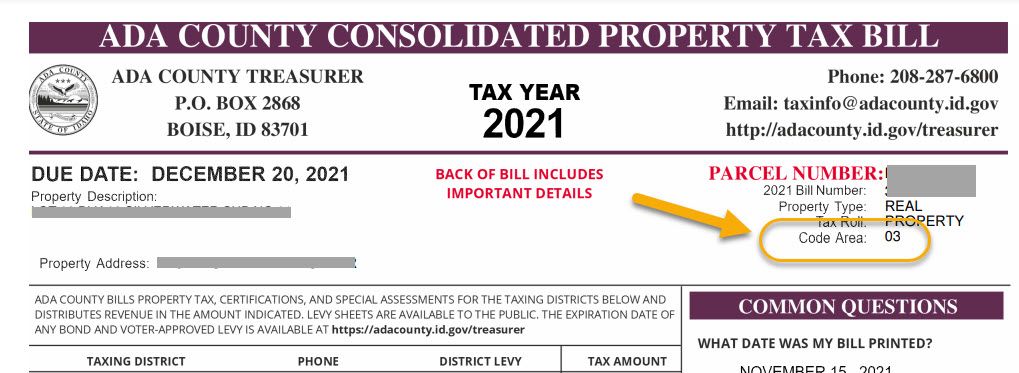

The Hayden Idaho sales tax is 600 the same as the Idaho state sales tax. The Ada County sales tax rate is. Depending on local municipalities the total tax rate can be as high as 9.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. The total tax rate might be as high as 9 depending on local municipalities. 31 rows The state sales tax rate in Idaho is 6000.

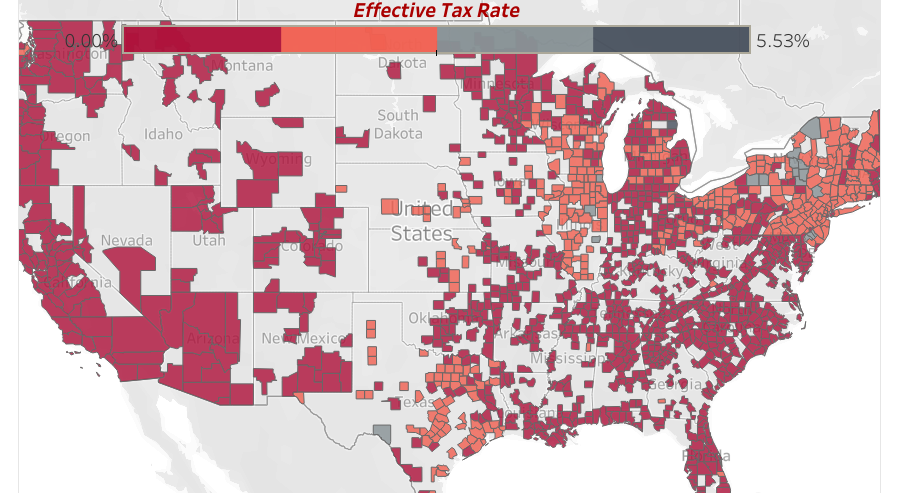

Property Taxes Levied On Single Family Homes Up 5 4 Percent In 2020 To More Than 323 Billion Dfd News

What S This Wayfair Fund I Keep Hearing About Idaho Reports

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho Sales Tax Rate Changes October 2014 Avalara

How To Charge Your Customers The Correct Sales Tax Rates

Move Oregon S Border For A Greater Idaho Move Oregon S Border For A Greater Idaho

Historical Idaho Tax Policy Information Ballotpedia

Sales Taxes In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Idaho S Circuit Breaker Changes Will Disproportionately Affect Low Income Seniors Idaho Capital Sun

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

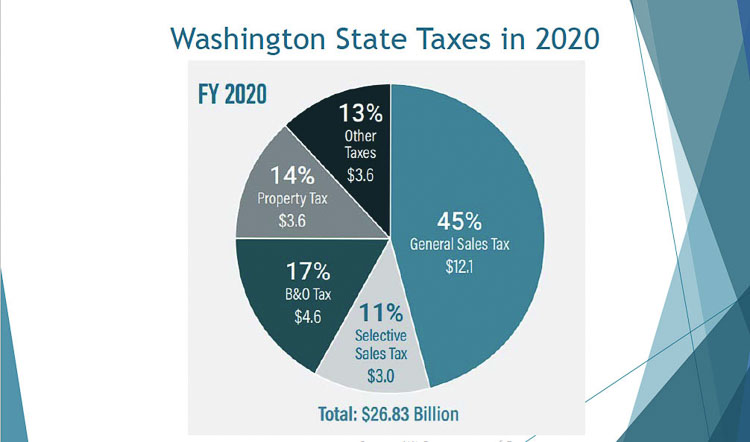

State Tax Structure Workgroup Seeks Input For Possible Changes To Washington Tax System Clarkcountytoday Com

Idaho Property Taxes Everything You Need To Know

Idaho Vehicle Sales Tax Fees Calculator Find The Best Car Price